This method can be used to see how costly production processes are over a set length of time too. We also provide tips on how to generally improve your accounting processes, whilst also detailing how our accounting software can take your finances to the next level. The software should have the ability to generate financial reports and provide insightful analysis of production performance. Manufacturing accounting refers to the specialized branch of accounting that focuses on the financial management and control of manufacturing operations within a business. It involves the application of accounting principles and practices to accurately track, analyze, and report the financial aspects of the manufacturing process.

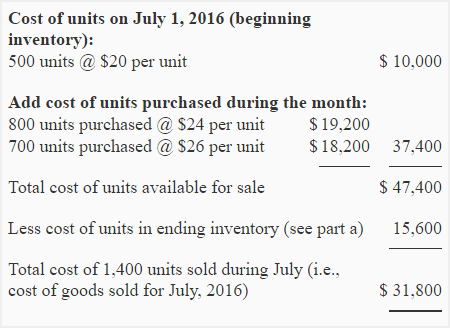

Many manufacturers use the ‘first-in, first-out (FIFO)’ method, where products are sold in the order they are added to inventory. A popular way of costing inventory; this could work for businesses that have products with a shelf life. You need to think beyond profit and loss to manufacturing costs such as the costs of materials, Manufacturing accounting plus the cost to convert these materials into products. This is necessary, for example, to understand how you should be pricing your product and how to achieve or exceed your set profit margins. Also known as factory overhead, manufacturing overhead refers to the cost of maintaining and operating your production facilities.

Get manufacturing know-how delivered to your inbox!

By having a safety net in terms of spend, it takes the pressure off when making an investment. The budget should be determined logically, by looking at factual data. You should look at profits from the previous year, and income / expenditure that is certain to take place over the coming months.

As a result, your finance team can access their work at any time and from any place. It is important to choose an accounting strategy that is suited to your business requirements. Cash basis accounting is a method that is predominantly used by smaller businesses (or those doing personal finance). It is a simpler approach, whereby profits and expenses are only reported once money has changed hands. This method is more about predicting what costs will look like going forward, and is a proactive approach.

PREPARING A MANUFACTURING ACCOUNT

Another among these is the distinction between variable and fixed costs. 5) Production cost – prime costs + factory overhead (remember this but not that simple). TrendingAccounting is a top small business blog that shares information about accounting, bookkeeping, tax, finance, and auditing. At TRG, we offer Infor SunSystems, a comprehensive financial management solution built with security and usability in mind. The solution is deployable on-premise or in the cloud and is packed full of capabilities aimed at increasing your productivity.

The Importance of Accurate Accounting in the Manufacturing Industry – Columnist24

The Importance of Accurate Accounting in the Manufacturing Industry.

Posted: Tue, 01 Aug 2023 09:17:10 GMT [source]

This means you pay a monthly fee for the service, rather than needing to pay a large setup fee (which ultimately protects cashflow). Any necessary support / upgrades are included in the monthly cost and can be done remotely. You should always have an appropriate amount of cash at hand, as you never know when an emergency or unexpected cost will crop up.

Activity-Based Costing Method in Accounting

In addition to per-part inventory costing, it is also important to track the total number of on-hand inventory units. The two common types that inventory can be arranged in light of this are the perpetual and the periodic inventory system. Nick Gallo is a Certified Public Accountant and content marketer for the financial industry.

However, the market for these systems is complex due to consolidation, new entrants and the increasing demands of enterprise resource planning (ERP) systems. A final aspect of manufacturing that largely informs manufacturing accounting is production costing. Since adding together direct costs is generally a straightforward affair, this mostly revolves around calculating the per-product share of indirect costs. There are various costing methods that each inform cost accounting in their own way.

Dealing with the Growing Threat of Cyberattacks in Manufacturing … – jacksonlewis.com

Dealing with the Growing Threat of Cyberattacks in Manufacturing ….

Posted: Tue, 15 Aug 2023 20:28:39 GMT [source]

The object and subsidiary accounts define the kind of transaction you are working with (for example, rent, paper supplies, and so on). They are the lowest organizational level within your business and the level at which you account for all revenues, expenses, assets, liabilities, and equity. This blog post will explore a range of indispensable tips and proven strategies specifically tailored to the unique challenges of accounting in manufacturing. Whether you possess years of experience in the field or are just beginning to navigate its complexities, these insights will help you ensure your financial operations run smoothly.

Accounting for Manufacturing Businesses

Manufacturers should also consider an accounting solution that integrates well with an asset management system or has a module specifically built to manage assets. The automation creates a standardised process from one single platform, freeing manufacturers up to focus on other mission-critical tasks. Manufacturers are also able to gain a better view of the entire fulfilment ecosystems, quickly identify errors or customer dissatisfaction due to incorrect invoices or transportation errors. Order management module gives businesses the ability to process and track orders, payment statuses, and invoices using one centralised system.

Manufacturing involves a significant amount of cost accounting, which is a notoriously complex subject. As manufacturing software evolves, accounting systems must change in step. More information is generated by newer MES and MRP systems than previous versions. Because of the increased complexity and the interfaces to other company and operations systems, accounting systems are more challenging than most. John Freedman’s articles specialize in management and financial responsibility. He is a certified public accountant, graduated summa cum laude with a Bachelor of Arts in business administration and has been writing since 1998.

Whether it’s on-premise or in the cloud, more and more systems are allowing the use of Web-based technologies like browsers to run the systems. This means that the computer power can be centralized and workstations only need to be able to run a browser. Since these systems interface with systems throughout the firm, it serves as a convenient library for all of the compliance reports. This can significantly reduce the cost of preparing compliance documents for government agencies. For a manufacturer with three inventory categories, these “logical” formulations must take on a repetitive nature for each category of inventory.

His career includes public company auditing and work with the campus recruiting team for his alma mater. The cost of goods sold Manufacturing account tracks information on all inventory items sold by the firm. If you want to take your accounting to the next level, read more about our cloud-based Manufacturing Software, which is tailored for small to medium-sized manufacturers. You should ensure that your finance team are given regular time to read about industry updates in the world of accounting. This way you can keep up with the competition and find new ways to enhance your processes.

This material transferred to production then reappears in the schedule of work in process that follows. Manufacturing businesses have to account for their raw materials and processing costs, but they also have to work out the value of the finished items they create. Professional accounting services can completely transform the manufacturing process and save you money on production costs while increasing profit. Further, for smaller manufacturers that aren’t equipped to have full-time accounting staff in-house, partnering with the right accounting service will make a world of difference. The system underlines LOD 3 on balance sheet reports and LODs 3 and 4 on income statement reports. Variable costs are expenses that a company bears proportional to its production volume.

Process Costing

This is better for high-value items that need differentiation, rather than interchangeable items. Very often, this is listed in a bill of materials, which itemizes quantities and costs the materials used in your product. In process manufacturing, such as food and beverage or chemicals, the bill of materials is known as a production recipe.

- Indirect costs are those that you can’t tie directly to the production process.

- At the end of your accounting periods, inventory valuation allows you to establish the cost of making the goods you sell versus how much profit you’re making.

- Whether you possess years of experience in the field or are just beginning to navigate its complexities, these insights will help you ensure your financial operations run smoothly.

Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content. Having these standards allows you to detect variances that can be analyzed, allowing trends to be spotted, and enabling you to make the right adjustments to pricing. If you are spending more on manufacturing the product than necessary, you will not meet your income targets. Manufacturing accounting is different to accountancy in other industries. One big difference is that rather than simply selling stock or services,… Mattias is a content specialist with years of experience writing editorials, opinion pieces, and essays on a variety of topics.

For example, the end-of-year statements will include an income statement and a balance sheet. In a manufacturing partnership or company, there will also be an appropriation account to show how profits have been dstributed. The main different is that it is necessary to work out just how much was spent on producing goods rather than on purchasing them. Businesses use several manufacturing accounts, but the most common are raw material, direct labor, overhead, work in process, finished goods, and cost of goods sold. Effective inventory management not only minimizes disbursement but also enhances operational efficiency and increases profitability. Manufacturing accounting systems offer valuable visibility into key aspects of inventory management, encompassing goods acquisition, stock valuation, and the calculation of moving average costs (MAC).

By looking at current and past performance, it becomes possible to gain insights that will influence successful product pricing and production strategy changes. In this article we look at the importance of accounting in manufacturing, and describe some of the methods that can be used. You assign levels of detail (LODs) to control which accounts are subtotaled during the rollup process. The system also displays the level of detail you view online and in printed reports. An account number includes both the business unit and object.subsidiary codes.

In order to ensure accuracy and efficiency in the process, there are certain best practices that should be followed. Also known as the lower of cost or market rule, impairment testing involves ascertaining whether the amount at which inventory items are recorded is higher than their current market values. This task may be completed at relatively long intervals, such as at the end of each annual reporting period. These articles and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”). Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage.

If you opt for a solution with customer and supplier invoicing capabilities, you can clearly see where your future income is coming from (which gives you a clearer picture of cashflow). And if it has asset management tools (including a depreciation calculator), you can see the value that is locked up in physical assets. A system that has unified ledger accounting (with all accounts structured in a hierarchical fashion) will remove the hassle of reconciling multiple ledgers. If you wish to do business globally, you should also look for a system that possesses multi-currency accounting.