If you’ve accurately kept track of and reported your employees’ clearing account salaries and wages, you can claim them with the Employee Retention Credit. With this credit, you can get up to $26,000 back per employee during COVID-19. Stay organized throughout the year, instead of scrambling at the end during tax season.

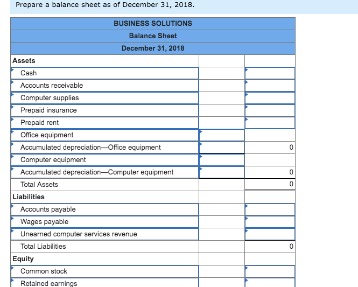

The equity section gives you the net worth of your business, which is the value of all your physical and non-physical assets. The more often you reconcile, the faster you’ll catch any overlooked transactions. We suggest turning reconciliation into a habit and doing it at least monthly to prevent the work from piling up and becoming overwhelming. Moving money from one account to another is like moving a five dollar bill from one pocket to another. You’re not actually making or losing any money—it’s just in a new place. As procrastination-worthy as it may seem, bookkeeping is a necessary part of successfully running your business.

Setting Up Accounting for Small Businesses

The thought of recording all of your business transactions may seem daunting. Jami fixed cost: what it is and how its used in business Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

Step 3: Reconcile your business transactions

Apart from having the data for your transaction on hand, you’ll need to decide which accounts that will be debited and credited. Your general ledger is organized into different accounts in which you record different types of transactions. Bear in mind that, in the world of bookkeeping, an account doesn’t refer to an individual bank account. Instead, an account is a record of all financial transactions of a certain type. Look at the item in question and determine what account it belongs to. For example, when money comes from a sale, it will credit the sales revenue account.

- Despite the importance of accurate bookkeeping practices, most people don’t feel entirely confident with maintaining detailed business finances.

- There are countless options out there for bookkeeping software that blends a good price with solid features and functionality.

- When hiring external team members, keep in mind that some of the responsibility still falls to you as the proprietor.

- Jami Gong is a Chartered Professional Account and Financial System Consultant.

QuickBooks

Accounting software can streamline your bookkeeping process and make your financial management more efficient. It’s useful for business owners looking to save time and avoid common accounting errors. The accrual accounting method records financial transactions when they occur rather than when cash exchanges hands. Small businesses need to keep accurate records relating to any expenses they incur, particularly for expenses they plan to deduct.

Store records securely

And sometimes it can be produced to include comparisons against the prior year’s same period or the prior year’s year-to-period data. Business accounting software and modern technology make it easier than ever to balance the books. A platform like FreshBooks, specifically designed for small business owners, can be transformational.

This will help you avoid having to outlay a significant amount of funds at the end of the year. Profit and loss statements is a recap of your business expenses, costs and revenues on specific dates. While your business is still fairly small, it’s worth focusing on getting the basics of bookkeeping right since you have a legal obligation to record financial data. The last thing you want to do is put off recording transactions in your books. Letting transactions pile up can lead to disorganized records, mistakes, and a whole lot of unnecessary stress.

You can follow our guide on how to make an income statement to accurately evaluate your business’s financial health. Software programs, apps, and tools can save your business time and potentially money if you’re able to ensure more accurate accounting. Using a software program can also eliminate the need to retain a full-time accountant, which can add to your accounts receivable collection business expenses.

Getting started with your bookkeeping or accounting can be stressful for any new business owner. Check with your banking institution to find out what documentation you need to provide to open a business bank account. It’s never too early to take ownership of your bookkeeping policies. By following the tips and best practices outlined in this guide, you’ll be more equipped to set a strong financial foundation for future growth, profitability, and ultimate success. But you still need to note that the money exited one account and entered another so you don’t accidentally duplicate any of your income or expenses.

The importance of accounting for small businesses can’t be underestimated. Whether you’re starting a brand-new business or you have some experience under your belt, creating a solid accounting plan can help you monitor and maintain your financial health. If you follow the tips we’ve laid out above, you’ll likely be able to focus some of your time on other important facets of your business. Never leave the practice of bookkeeping (or your business assets) to chance.